The Evolution of Money: How Money Shaped Our World

- Mahendra Rathod

- Mar 11

- 3 min read

Updated: Mar 19

Money is humanity's most fascinating and impactful invention, a universal language spoken by every culture. Inspired by Yuval Noah Harari's insights in his book Money, this blog explores how money evolved, revolutionised societies, and continues to shape our future.

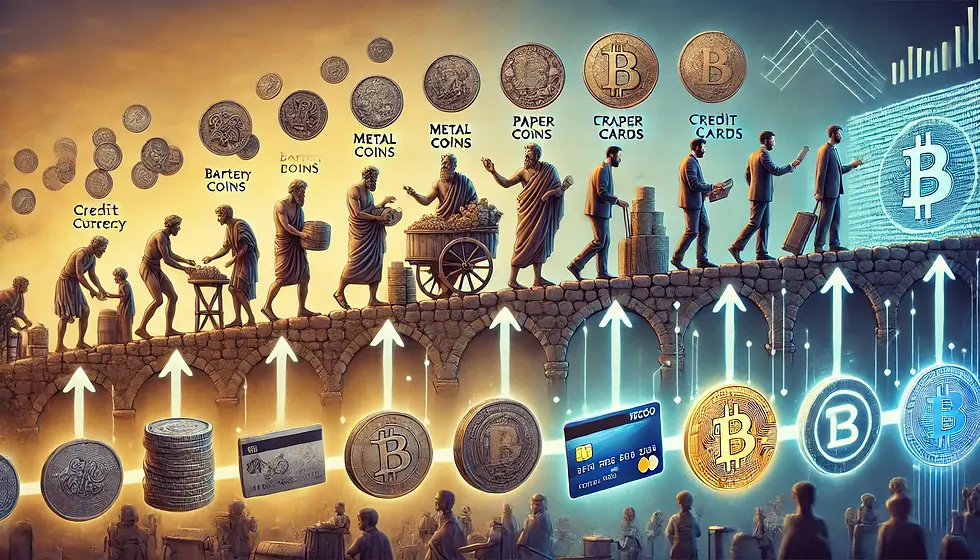

Evolution of Money: Bartering to Coinage

In the beginning, there was barter—an exchange system where people swapped goods directly. But this system had some major challenges:

Difficulty in finding suitable trading partners

Valuation discrepancies between goods

Problems with transporting and storing bulky goods

To overcome these problems, early societies invented commodity money—objects like cattle, salt, and seashells, which had intrinsic value.

Trivia:

Cowrie shells were among the earliest forms of money, used extensively across Africa, Asia, and Oceania.

The Aztecs famously used cocoa beans as currency; a turkey cost about 100 beans.

Around 600 BCE, the Kingdom of Lydia (modern-day Turkey) minted the world's first official coins made from electrum, a mix of gold and silver.

Paper Money and the Banking Revolution

The Chinese introduced paper money during the Tang Dynasty (618-907 AD) due to copper shortages. By Marco Polo's time (13th century), he marvelled at how the Chinese confidently used paper currency, a concept that bewildered medieval Europe.

Europe's modern banking system originated in Renaissance Italy, led by the powerful Medici family. They popularised banking innovations such as promissory notes, cheques, and double-entry bookkeeping, creating the financial backbone of modern capitalism.

Trivia:

The earliest European paper money was printed in Sweden in 1661.

The Bank of England, founded in 1694, was initially established to raise funds for war against France.

Leonardo da Vinci designed early versions of secure banknotes to prevent forgery.

Gold Standard: Stability and Its Demise

In the 19th century, the gold standard emerged, backing paper money with gold reserves. This provided stability but restricted governments' financial flexibility. The Great Depression exposed its limitations, leading President Richard Nixon to abandon the gold standard entirely in 1971, transitioning to fiat money—money backed solely by government trust.

Trivia:

Ancient Egypt standardised gold bars around 2600 BCE, predating modern financial standards by thousands of years.

In the late 19th century, the U.S. had heated debates known as the “Silver vs. Gold” controversies, significantly influencing politics and economics.

Nixon’s decision in 1971 was famously called the "Nixon Shock," dramatically reshaping global economics overnight.

Digital Money: Cards, Cryptocurrencies, and Cashless Societies

Today, most financial transactions are digital. The rapid rise of credit cards, online banking, and mobile payments has drastically reduced cash usage worldwide.

Cryptocurrencies like Bitcoin (2009) introduced blockchain technology—a decentralised ledger system that removes banks from financial transactions. Ethereum further advanced blockchain technology by enabling "smart contracts," automated agreements executed without human oversight.

Trivia:

Bitcoin's anonymous creator "Satoshi Nakamoto" remains unidentified, making it one of the great mysteries of the digital age.

Pizza was the first-ever real-world purchase using Bitcoin; two pizzas were bought in 2010 for 10,000 Bitcoins, worth millions today.

Estonia was one of the earliest adopters of blockchain technology, utilising it for secure government records since 2012.

Money: A Powerful Shared Fiction

Harari argues compellingly that money is essentially a collective fiction—a universally accepted story. Its value lies entirely in our trust, enabling humans to cooperate and build complex societies.

Trivia:

Zimbabwe printed a $100 trillion note due to hyperinflation, becoming a collector’s item.

The U.S. dollar is made from 75% cotton and 25% linen, making it highly durable.

Sweden is rapidly approaching becoming the world's first completely cashless society, with less than 10% of transactions now involving physical money.

Future of Money: Beyond Digital

Money is now evolving faster than ever, driven by technology, decentralisation, and globalisation. Key trends include:

Decentralised Finance (DeFi): Removing intermediaries like banks from financial transactions.

Artificial Intelligence (AI): AI-managed trading and personalised financial planning.

Central Bank Digital Currencies (CBDCs): Nations developing digital currencies to enhance efficiency and control.

Space Economy: Exploring new forms of currency for interplanetary commerce.

Trivia:

El Salvador became the first country to adopt Bitcoin as legal tender in 2021.

Central banks, including China’s People's Bank, are testing digital currencies to maintain monetary sovereignty.

Recommended Reading on Money

Explore further with these insightful books:

Final Thoughts

Money’s evolution has been astonishing, influencing every aspect of human history and society. As it becomes increasingly digital and decentralised, our trust in money—as a concept—will continue to shape the future of civilisation.

How do you envision money in 50 years? Will cryptocurrencies become dominant? Could cash disappear entirely? I’d love to hear your thoughts!

コメント